This product offering is currently unavailable. We will be back soon. Till then please explore our other products.

Everything of great value is built over time. If you are in your 20s and killing it in your career then look back at your childhood and think. The seeds of becoming an accountant were probably sowed when you did well in math tests year after year. If you are a lawyer you would very well recall dinner table conversations which turned into detailed arguments. Consciously or not, the efforts you made when you were younger have placed you where you are today.

In a similar vein, the investments you make today will determine your financial well-being in the future. While you can start investing at any point in your life, there's nothing better than starting early. Here are five reasons why that's true:

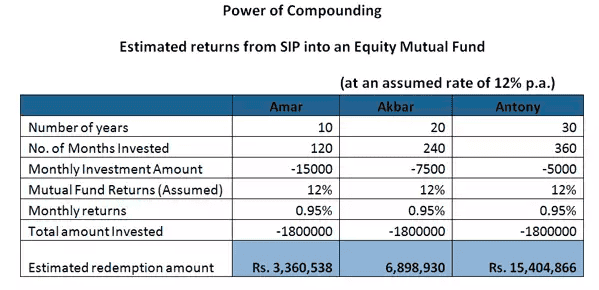

This is the central tenet of investing. Yet, many young investors are unaware. That is where apps like Moneyfy close the gap. Moneyfy provides a convenient platform for investing in mutual funds and accessing the power of compounding early on in life. If you give your money enough time and a little care it will reap great dividends along the way. Let's illustrate this with an example.

Suppose you want to invest Rs 1,000 a month in one of the index funds for 35 years — the length of a usual career. An index mutual fund is a passive investment option as the rate of return is an average of its components. Yet, they have been seen to give returns in double digits over long periods such as 30-40 years. Let's assume our fund gives us a very conservative 10% annual return. In this case you would have invested Rs 4,20,000 over 35 years and the amount would have grown to Rs 34,25,893 — an eight fold growth. If we run the same calculation for 25 years, you would have invested Rs 3,00,000 and it would have grown to Rs 12,43,159 — a fourfold growth.

But the most surprising thing is this — investing Rs 1.2 lakh spread in an index mutual fund over 10 years can make a difference of Rs 20 lakh at the end!

Source: Economic Times

Additional Read: What Is The Power of Compounding & How Can You Use It?

Youngsters in their 20s generally have fewer responsibilities to shoulder. This means they put away a bigger proportion of their earnings towards investments. An app like Moneyfy from Tata Capital allows you to invest whatever amount you save from your monthly expenses into a Mutual Fund according to your need. This is as convenient as it gets. The benefit of that is a diversified portfolio. For example, a younger person can invest their fixed regular savings into a low risk SIP. However, the additional savings through the can be put into a high risk mutual fund as a lump sum. While the former can be helpful in terms of emergency, the latter could grow and aid in wealth creation.

Most people don't have a home loan or a pension fund in their 20s. They might not even have a health insurance plan (it is advisable to have one). Since these things look too far into the future for young millennials, they end up losing out on tax savings. ELSS funds could be one of the solutions in such a case.

Equity Linked Saving Schemes or ELSS funds are a category of mutual funds that have a lock-in period of three years and are eligible for tax deduction of up to Rs 1,50,000 under section 80C of the Income Tax Act, 1961. Investing in ELSS funds could get you high returns and at the same time keep you invested in a diversified portfolio of companies. With the Moneyfy app, you can save tax up to the tune of Rs 46,800.

Additional Read: Is ELSS a Wealth Creation & Tax-Saving Tool?

You might dream of a certain kind of a house and backpacking across Europe. Investing in a good mutual fund SIP could help you achieve both. If you are finding it difficult to set goals, an app like Moneyfy can help you. Its goal based investing feature allows you to set desired goals and accomplish them by investing right. And the best part is it doesn't mean you need to cut all your expenses. Just putting off a weekend club hopping episode once a month and putting that amount in an SIP would help you realise your long term financial goals easily. You can also invest a lump sum if you wish.

The world is experiencing one of the worst economic downturns in modern times owing to the pandemic. With a spate of layoffs and pay cuts happening all around us, it's time to build a moat for your future. As health and economic uncertainties pervade our lives, one can never be too secure. Moreover, the nature of jobs is changing as the gig economy takes shape. As such it is important that youngsters start investing early and future proofing themselves.

More than anything youngsters have time on their side. Wealth is a plant that grows in the soil of time. Starting early is integral because it averages out big events that may hurt a portfolio once in a while. For an investing beginner, it's important to start with a safe bet — mutual fund SIP is one such avenue. Moneyfy from Tata Capital is user-friendly and allows you to screen mutual funds to pick your investment type as well as compare various funds. It is an apt platform to start your investment journey from.

Tata Capital offers various mutual fund plans across large cap, mid cap, small cap that could help you achieve your financial goals and diversify your portfolio. You might also want to try out the Moneyfy app from Tata Capital for a hassle-free way of screening mutual funds and investing in them.