When it comes to safe, long-term investment options, few match the reliability of the Public Provident Fund (PPF). Backed by the Indian government, PPF is a trusted long-term investment that allows you to grow your money securely. To learn more about what is PPF, PPF meaning and how it works, keep reading.

What is the Public Provident Fund's Meaning?

The PPF's full form is Public Provident Fund. Introduced in 1968, this scheme was designed to encourage small savings in a secure environment while helping individuals build a retirement corpus over time. It is especially suited for risk-averse investors seeking guaranteed returns and tax benefits.

How Does a PPF Account Work?

You can open a PPF account at designated banks or post offices, with a minimum annual deposit of Rs. 500 and a maximum of Rs. 1.5 lakh. The account has a 15-year lock-in period, which can be extended in 5-year blocks after maturity. You can make deposits either in a lump sum or through up to 12 instalments during the year.

How to Invest in PPF?

You can open a PPF account either offline or online, as long as you meet the eligibility criteria. To activate it online, simply visit the website of your chosen bank or post office. When opening a Public Provident Fund account, you'll need to provide the following documents-

- KYC documents to verify your identity (Aadhaar, Voter ID, or Driver's License)

- A passport-sized photograph

- Proof of residential address

- Nominee declaration form

- PAN card

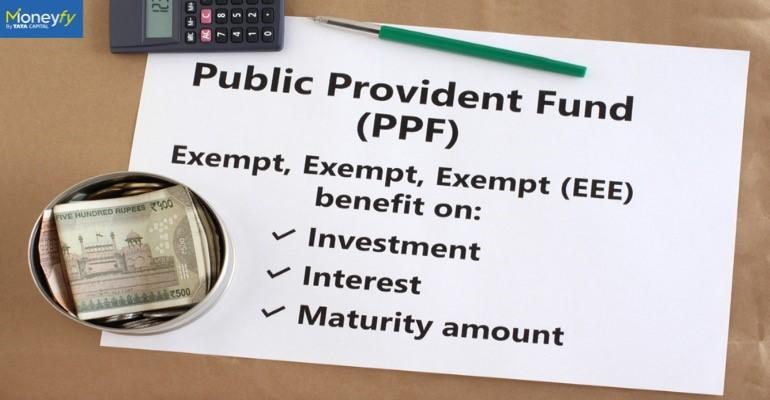

What are the Key PPF Benefits?

Some of the main benefits of investing in PPF are-

- Tenure

After the initial 15-year lock-in, you can either withdraw the full amount or extend the tenure in 5-year blocks.

- Interest rate

The government revises the PPF interest rate quarterly. As of Q1 FY 2025-26, the rate is 7.1% annually, which is often higher than many fixed deposit rates.

- Tax benefits

PPF contributions are eligible for tax deductions under Section 80C, and both the returns and principal are tax-free.

PPF partial withdrawal rules provide flexibility while ensuring long-term savings discipline, making it a great investment option. For more investment opportunities and expert guidance, visit the Tata Capital Moneyfy website or download our app today!

Popular Searches

Learn Center

Mutual Fund Investment

Calculators

FAQs

There is no specific age limit to open a PPF account. However, starting in your 20s or 30s allows your investment to grow through compounding over the 15-year lock-in period.

You're not required to withdraw the balance. You can extend your PPF account in 5-year blocks, with or without further contributions, and continue earning interest.

Partial withdrawals can be made from the 7th financial year, limited to 50% of the balance from the 4th year or the previous year.

Once the minor attains the age of 18 years, the guardian must request the transfer by submitting a valid ID to the bank or post office.

2 mins read

2 mins read

Previous Post

Previous Post