What is Systematic transfer plan (STP)?

A Systematic Transfer Plan (STP) is a facility offered by mutual fund companies that allows investors to move their investments from one scheme to another within the same fund house. Typically, the transfer is done gradually from a debt or liquid fund to an equity-based fund so investors can systematically gain exposure to the market and the associated volatility.

STP in mutual fund is most beneficial for investors with a lump sum who prefer not to invest it all at once or time the market. Instead, they can gradually shift their investment into equity, gaining exposure over time.

In this article, we explore what is systematic transfer plan, and the types and benefits of STPs.

Types of Systematic Transfer Plans?

There are three types of STP in mutual funds:

Fixed STP: In a fixed STP, the total amount and frequency of the transfer are fixed as chosen by the investor at the beginning of the plan.

Flexi STP: As the name suggests, the flexi STP option offers flexibility to the investor in regard to the transfer amount. The investor can choose a variable amount to move from the source fund to the target fund. The choice can be made based on market fluctuations. Investors usually use this option during a volatile market. If the Net Asset Value (NAV) of the target fund decreases, investors transfer more funds to get a higher number of units, and vice versa.

Capital Appreciation STP: Under this plan, the capital appreciation earned from one mutual fund scheme is transferred to another fund. The essential thing to note here is that this type of plan only moves the gains earned from market appreciation from the source fund to the destination fund, with the purpose of making higher returns.

Investors can choose any of these there options based on their risk appetite, financial goals, and expertise. For instance, the flexi and capital appreciation STP options may be suitable for experienced investors who can spot emerging opportunities in the market and accordingly make the right moves. On the other hand, a fixed STP may be more suitable for novice investors who lack the know-how and experience in the market.

Find the difference between

SIP, STP and SWP

Nature of the plan

Process followed

Financial Goal of the Plan

Estimated Returns

Taxability on the plan

SIP

Nature of the plan

Light on Pocket

Process followed

Disciplined payment/ Investment Habit

Financial Goal of the Plan

Disciplined payment/ Investment Habit

Estimated Returns

Rupee Cost averaging

Taxability on the plan

Tax Efficient

STP

Nature of the plan

Rebalancing of Portfolio

Process followed

Consistent Returns

Financial Goal of the Plan

Cost Averaging

Estimated Returns

Consistent Returns

Taxability on the plan

Tax Efficient

SWP

Nature of the plan

Regular Income

Process followed

Regular Income

Financial Goal of the Plan

Avoid market Fluctuation

Estimated Returns

Regular Income

Taxability on the plan

Tax Efficient

Features of Systematic Transfer Plan

Here are some features of an STP:

Minimum Investment: Although there is no minimum investment mandated by the Securities and Exchange Board of India (SEBI), some asset management companies ask for a minimum investment of Rs 12,000.

Minimum Transfer: Investors need to make a minimum of six transfers under STP.

Entry and Exit Load: There is no entry load in a Systematic Transfer Plan. However, fund houses can charge a maximum of 2% as the exit load. Additionally, there is no exit load in the case of a transfer made from a liquid fund to an equity fund.

Multiple Options: Investors can transfer funds from any mutual fund scheme to another as long as it is within the same asset management company. Further, investors have multiple types of STPs to choose from.

Taxation: Even though you transfer funds, the transaction is considered a withdrawal/ redemption for taxation purposes and taxed according to the prevailing short and long-term capital gains taxes for debt and equity funds.

Benefits of Systematic Transfer Plan

Here are some benefits of an STP:

Higher Returns: A Systematic Transfer Plan can help investors earn better rewards. Investors can maximize their returns by shifting to mutual funds that offer a higher return potential and discarding the ones that are not performing optimally.

Security Against Market Volatility: STPs allow investors to shift from risky mutual funds to relatively safer investment options during market volatility. This lowers risk and protects their investments.

Rebalanced Portfolios: Reviewing and rebalancing the portfolio is an integral part of investing. STP is a great strategy to rebalance your portfolio and maintain the desired asset allocation between debt and equity mutual funds.

Rupee Cost Averaging: A Systematic Transfer Plan allows you to buy fewer units when the price is high and higher units when the price is low, thus averaging out the cost of investment.

Why Choose STP?

Systematic Transfer Plan is an automated transfer plan that allows you to transfer money from one Mutual Fund scheme to another, every month. It aids in capital appreciation for idle money. Here are Some of the benefits

Things to Remember when Investing with a Systematic Transfer Plan

- Long-term investment: A systematic transfer plan works best in the long term. They are not designed for short-term gains, and investors should manage their expectations accordingly.

- Exit load and taxes : While making a withdrawal from a scheme, an exit load may apply, depending on the duration of the holding. Additionally, capital gains tax may be levied, making it important to assess the tax impact before initiating an STP.

- Risk is not eliminated : STPs help reduce market timing risk by spreading investments over time, but they do not eliminate the risk entirely. Since funds are eventually moved to market-linked instruments, they remain subject to fluctuations associated with the market.

- Minimum transfers: According to the rules laid down by SEBI, investors have to commit to at least 6 instalments in order to set up their systematic transfer plan.

FAQs

VIEW ALLCan I choose the withdrawal amount or is it fixed?

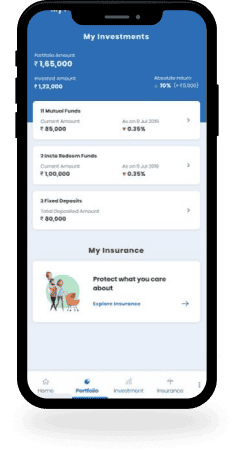

Fulfill your most cherished life goals with our suite of financial products. Buy the house of your dreams, pay for your education, build a solid retirement corpus – do it all at Moneyfy.

When to use SWP?

Fulfill your most cherished life goals with our suite of financial products. Buy the house of your dreams, pay for your education, build a solid retirement corpus – do it all at Moneyfy.

Can individuals who are not retirees invest in an SWP?

Fulfill your most cherished life goals with our suite of financial products. Buy the house of your dreams, pay for your education, build a solid retirement corpus – do it all at Moneyfy.

Can I get a Loan against FD?

Fulfill your most cherished life goals with our suite of financial products. Buy the house of your dreams, pay for your education, build a solid retirement corpus – do it all at Moneyfy.

What is the minimum deposit required to open an FD account?

Fulfill your most cherished life goals with our suite of financial products. Buy the house of your dreams, pay for your education, build a solid retirement corpus – do it all at Moneyfy.

How Does Systematic Transfer Plan Work?

An STP is an investment strategy that allows you to gradually shift your funds from a low-risk scheme to a high-risk scheme within the same fund house. This gradual shift helps manage market volatility, reduces timing risk, and offers a more disciplined approach to investing.

How To Set Up a Systematic transfer plan?

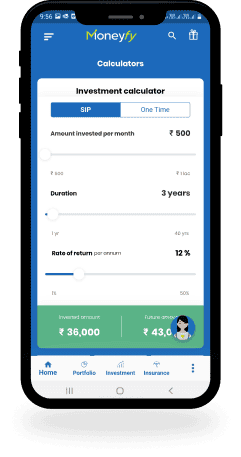

To set up an STP you can either request your wealth manager to do so, or fill the required forms in offline mode and submit it to the AMCs. You can also do it directly via your investment application.

Is STP Better Than SIP?

Both STPs and SIPs serve different purposes and are ideal for differing financial situations. An SIP is ideal when you’re investing small amounts regularly and want to build wealth gradually through disciplined investing.

An STP is more suitable if you already have a lump sum amount. Instead of investing the entire amount in one go, you park it in a low-risk fund and systematically transfer it into an equity fund.

How does a systematic transfer plan help you deal with volatility?

In a systematic transfer plan, all the funds are not invested in equity markets in a single go. They are parked in low risk or liquid funds and are systematically transferred over a certain period to equity funds.

Is a systematic transfer plan good for investors?

A systematic transfer plan is suitable for investors who have a lump sum and do not want to gain exposure to market volatility in a single go.

What does STP mean?

STP is a systematic transfer plan that allows investors shift their investments from one scheme to the other within the same fund house over a period of time.

What are the benefits of STP in mutual funds?

STP in mutual funds offers long-term growth by systematically shifting investments from low-risk to high-risk schemes. It minimises equity market risk through gradual exposure and is more tax-efficient compared to lump sum investing. It also provides better cash flow management for investors holding a large corpus.

Is STP a good option?

Yes, STP is a good option for investors who have the ability to invest a huge amount at one time and want to avoid equity market risk in a single go.

What is the minimum amount for STP?

SEBI has not laid a requirement for minimum amount in STP. It's advisable to check the specific requirements of the mutual fund scheme before starting an STP.

What are the disadvantages of STP in exit loads?

If the units of one scheme are redeemed before a certain period, the STP will be subject to an exit load on transfer. This means a small fee will be deducted by the fund house at the time of transfer, which can reduce the overall returns from your investment.

What are the disadvantages of STP in mutual funds?

If amount is withdrawn from a scheme before the completion of a certain period, the transfer can attract an exit load.

Which is better—SWP or STP?

SWP (Systematic Withdrawal Plan) allows regular withdrawals from a fund, gradually reducing the investment corpus. STP (Systematic Transfer Plan), on the other hand, shifts funds from one scheme to another, usually from debt to equity, allowing the corpus to grow. The better option depends on whether your goal is income generation (SWP) or capital appreciation (STP).

Is STP tax-free?

No, STP is not entirely tax-free. Although it involves internal transfers, each transfer is treated as a redemption from the source scheme, which may attract capital gains tax depending on the holding period and asset type.

When to use STP in mutual funds?

STPs should be used when you have a lumpsum to invest and do not want to gain exposure to the equity markets at once. By transferring funds gradually from a low-risk scheme to an equity fund, you can manage market volatility while staying invested.