What is a Systematic Withdrawal Plan?

A Systematic Withdrawal Plan (SWP) is a facility that lets you redeem or withdraw your funds from a mutual fund scheme in a planned and phased manner. A lump sum withdrawal can trigger high taxation. Additionally, you may not have a use for lump sum funds. A Systematic Withdrawal Plan allows you to break down your distributions into installments. This lowers your tax liabilities, enables better money management, and keeps a part of your money still invested in the mutual fund scheme.

You can customize your SWP plan in mutual fund schemes according to your needs and financial goals. You can set the frequency and amount, as well as opt for the withdrawal of only capital gains. Further, the amount you withdraw through a Systematic Withdrawal Plan can be used for your expenses or reinvested into another investment option. This is a common way for investors to explore other market opportunities.

How Does a SWP Work?

To fully understand the Systematic Withdrawal Plan meaning, it is crucial to know how it works. Here’s an example that can help:

Imagine that you invest Rs 1.5 crore in a mutual fund and will require a regular income of Rs 50,000 per month following retirement. You would then set up an SWP with the respective asset management company so that every month, Rs 50,000 would be transferred to your bank account for you to use for daily expenses.

However, the actual value of the SWP will be determined by the units in your mutual fund scheme and the scheme’s prevailing NAV (Net Asset Value). For example, in the above scenario, if the NAV is Rs 10, and you want to withdraw Rs 50,000 per month, you would have to sell 5,000 units of the fund to redeem the required value. But if the NAV increases to Rs 20, you would only have to sell 2,500 units of the fund to redeem the value needed. Mutual fund redemptions are not like withdrawing funds from a bank account or a deposit. The value of the NAV will be determined by the number of units you have left in your fund after every withdrawal.

The number of units in your scheme will keep reducing with every SWP until you have redeemed all your money. The higher the NAV, the fewer units you will have to redeem, and vice versa. Therefore, it is crucial to select the best SWP mutual fund plan for your withdrawals and thoroughly study the market and the fund’s NAV when determining your redemptions. Any unplanned withdrawals may also impact your overall return and the status of your future earnings.

Here is a table to explain better explain this:

Month | NAV (Rs) | Withdrawal Amount (Rs) | Units Redeemed | Units Remaining |

January | 10.00 | – | – | 15,00,000 (Rs 1.5 crore) |

February | 10.00 | 50,000 | 5,000 | 14,95,000 |

March | 12.00 | 50,000 | 4,167 | 14,90,833 |

April | 8.00 | 50,000 | 6,250 | 14,84,583 |

May | 20.00 | 50,000 | 2,500 | 14,82,083 |

June | 10.00 | 50,000 | 5,000 | 14,77,083 |

Benefits of a Systematic Withdrawal Plan (SWP)

A Systematic Withdrawal Plan (SWP) offers mutual fund investors a reliable way to generate regular income while keeping their investments active. Here are the key benefits of SWP.

- Regular income - SWP allows you to withdraw a fixed amount at regular intervals, providing a predictable cash flow. This feature is especially useful for retirees or those seeking additional income without fully liquidating their investments.

- Tax benefits - No TDS is applied to withdrawals through SWP, making it a tax-efficient option for investors.

- Customisation and flexibility - Investors have full control over the frequency and amount of withdrawals. You can adjust or stop the plan anytime to suit your financial needs.

- Compounding advantage - The remaining corpus continues to grow through compounding, maximising your returns over time.

- Volatility management - By spreading out withdrawals, SWP helps mitigate the impact of market fluctuations, providing a buffer against volatility.

- Investment discipline - Much like an SIP encourages disciplined investing, SWP promotes a systematic approach to withdrawals, preventing panic decisions during market downturns.

SWP can be a smart solution for those looking to balance income and investment growth.

Here are some essential features of a SWP:

- SWPs are designed to help investors redeem units regularly

- Investors can choose the frequency of their withdrawals

- They can decide to withdraw fixed amounts of income, or only the capital appreciation

- SWPs are ideal for investors looking for regular income from their investments

Why Choose SWP?

Systematic Withdrawal Plan is an automated withdrawal plan that allows you to periodically withdraw from one mutual scheme, with a goal to provide you a source of regular income.

Benefits and Features

- Allows you to withdraw and reinvest

- Provides fixed flow of income

- Capital appreciation in the long run

- Flexibility to choose the amount & time

- Tax efficient returns

Why Is the Systematic Withdrawal Plan a Good Investment Option?

A Systematic Withdrawal Plan is not subject to Tax Deductions at Source (TDS), which helps in lowering your overall tax output. Further, you can choose only to withdraw your capital gains and let your principal capital stay invested in the mutual fund scheme to garner more returns. This offers the dual benefits of a regular income and continued investment for further gains. So you can remain invested and target your future financial goals.

Tax Implications of Systematic Withdrawal Plans

SWP taxation is a critical aspect to keep in mind when planning your withdrawals. All withdrawals from mutual funds are taxed as short- and long-term capital gains. The tax rate differs for debt and equity mutual funds. Here’s how this is done:

Equity mutual funds:

Mutual funds held for a year or more are taxed as long-term capital gains at 10% on profits exceeding Rs 1 lakh

Mutual funds held for less than a year are taxed as short-term capital gains at 15%

Debt mutual funds:

Mutual funds held for three years or more are taxed as long-term capital gains at 20% with indexation

Mutual funds held for less than three years or more are taxed as short-term capital gains at the prevailing income tax slabs

The best Systematic Withdrawal Plan can be created after carefully understanding the impact of these tax laws on your money.

FAQs related to SWP

VIEW ALLCan I choose the withdrawal amount or is it fixed?

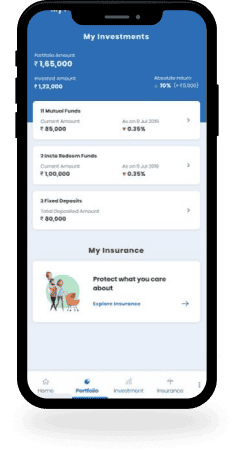

Fulfill your most cherished life goals with our suite of financial products. Buy the house of your dreams, pay for your education, build a solid retirement corpus – do it all at Moneyfy.

When to use SWP?

Fulfill your most cherished life goals with our suite of financial products. Buy the house of your dreams, pay for your education, build a solid retirement corpus – do it all at Moneyfy.

Can individuals who are not retirees invest in an SWP?

Fulfill your most cherished life goals with our suite of financial products. Buy the house of your dreams, pay for your education, build a solid retirement corpus – do it all at Moneyfy.

What Is SWP In Mutual Fund?

SWP (Systematic Withdrawal Plan) in mutual funds allows you to withdraw a fixed sum of money at regular intervals from your mutual fund investments, giving you a steady income while keeping the remaining investment intact.

Who Can Use SWP?

Anyone looking for a regular income from their mutual fund investments can use SWP. It's suitable for those comfortable with some market risk, as the returns are linked to the fund's performance.

What are SWP Interest Rates?

SWP interest rates refer to the returns from mutual funds that allow regular withdrawals. These rates vary based on the fund's performance and market conditions. Evaluate the fund's overall returns before investing.

Is SWP Available for All Types of Mutual Funds?

SWPs are generally available for most types of equity and debt mutual funds. However, it is important to consult with your mutual fund provider for more information.

What is the Minimum Amount I Can Withdraw Using an SWP?

The minimum withdrawal you can make using a SWP will vary depending on the mutual fund. However, the amount is generally quite low, ranging from Rs 500 to Rs 100 at the minimum.